Gefragt von: Sathilogan Kannappan

Fragesteller AllgemeinesAto Portal Individuals

Der Link der Ato Portal Individuals-Seite ist unten angegeben. Seiten, die sich auf Ato Portal Individuals beziehen, werden ebenfalls aufgelistet.

Zuletzt aktualisiert: 2022-01-29

Befolgen Sie diese einfachen Schritte:

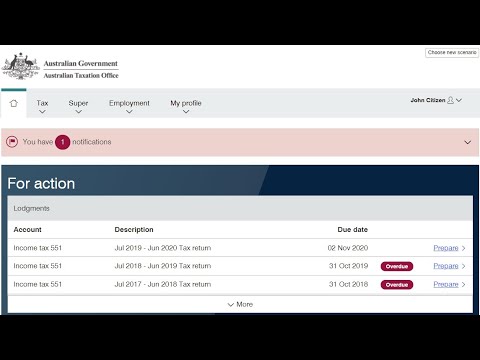

- Schritt 1. Gehen Sie über den offiziellen Link unten zur Seite Ato Portal Individuals.

- Schritt 2. Melden Sie sich mit Ihrem Benutzernamen und Passwort an. Der Anmeldebildschirm wird nach erfolgreicher Anmeldung angezeigt.

AU

AU US

US